This week in Product | Strategy | Innovation we will continue a series of updates on Elon Musk’s vision for a sustainable energy future. These are sprints to build a long-form profile as we have done for Spotify [E4] and Square [E5]. This update will focus on the Advanced Battery Technology used to power much of the Tesla ecosystem.

Early in Tesla’s journey into electric vehicles (EVs) the company bet on lithium-ion over Nickel Metal Hydride (NiMH) and lead acid cell chemistries. And regarding the format, Tesla aligned with the cylindrical cell design over prismatic and pouch cell designs. Most EV manufacturers use prismatic and pouch cells, but Tesla anticipated higher energy density and automated manufacturing advantages with cylindrical cells would lower unit production costs as unit volumes scale. This is the fundamental principle of Wright’s Law we covered in [E3.1]. Over the last decade, Tesla has continued to iterate the cylindrical cell design and chemistry working primarily with Panasonic, but also other manufacturers, leading scientists and academic institutions.

Tesla used the 18650 (18 mm diameter and 65 mm height) lithium-ion cell design in the Model S and X due to its reliability, use as an industry standard and readily available supply chain versus something proprietary when building out the initial fleet. However, Tesla also started exploring different lithium-ion chemistries and cell designs. With the Model 3, Tesla and Panasonic introduced the 2170 lithium-ion battery cell (21 mm diameter and 70 mm height and dropped the trailing 0) with a proprietary chemistry for about a 10-15% higher energy density. These 2170 cells generate about 2x the current of the prior design, but at a similar cost. The 2170 cells are mass produced at the Tesla Giga Nevada factory outside of Reno, Nevada where Panasonic produces the battery cells and Tesla packages those cells into modules and packs for final assembly in electric vehicles in Fremont, CA or another location. The 2170 cells are still used today.

Battery Basics

A lithium ion battery is made up of an anode, cathode, separator, electrolyte, and two current collectors (positive and negative). The anode and cathode store the lithium. The electrolyte carries positively charged lithium ions from the anode to the cathode and visa versa through the separator. The movement of lithium ions creates free electrons in the anode that creates a charge at the positive current collector. The electrical current then flows from the current collector through any devices being powered to the negative current collector. The separator blocks the flow of electrons inside the battery.

While the battery is discharging to provide an electric current, the anode releases lithium ions to the cathode, generating a flow of electrons from one side to the other. When charging the battery using an external power source, the opposite happens: lithium ions are released by the cathode and received by the anode.

Two other important battery concepts are energy density and power density. Energy density is measured in watt-hours per kilogram (Wh/kg) and is the amount of energy a battery can store relative to its mass. Power density is measured in watts per kilogram (W/kg) and is the amount of power that can be generated by the battery relative to its mass. Using an analogy of a swimming pool, energy density is similar to the size of the pool, while power density is comparable to draining the pool as quickly as possible.

Battery Day

On September 9, 2020, Tesla held its Battery Day at their factory parking lot in Fremont, CA in front of a socially distanced audience hosted in Tesla vehicles during the pandemic. At this event, Tesla laid out their future plans for lithium-ion batteries used across their product portfolio. A video of the event is provided below, but I will also highlight their battery strategy below.

There are 4 key benefits associated with all of the advances announced at Tesla’s Battery Day:

Cathode improvements enable 1 million mile batteries (outcome: total cost of ownership reduced with the most expensive component lasting 2-3x longer)

Driving range on a full charge increased by 54%

Charge time reduced by 40%

Battery cost decreased by 56%

At the Battery Day, Tesla announced a 5-step plan to cut the cost per kWh in half while also increasing energy density in specific chemistries. These 5 steps include:

Cell Design

Cell Factory

Anode Materials

Cathode Materials

Cell-Vehicle Integration

We will cover these separately plus their impact across the Tesla product portfolio.

1. Cell Design

Tesla announced major advancements in their lithium-ion cell design at Battery Day. Prior designs use a jelly roll to wrap the cell into the cylindrical shape with a single separator tab to connect the cell to the positive terminal. That requires electrons to travel around the cylinder to exit through the tab.

Manufacturing the jelly roll requires heat to dry out the conductive jelly. Tesla acquired Maxwell Technologies in 2019 for their dry battery cell technology. This process eliminates the jelly roll for manufacturing efficiency with a simpler process.

Tesla also introduced a tabless cell design to improve the efficiency of the operating cell. This reduces parts. With the tabless design electrons no longer have a single path to the positive terminal, but can take many paths within each layer to the positive terminal. This aids both charging and discharge and reduces the electrical path by 5x.

And finally, Tesla revised the cell size to further drive manufacturing efficiency per kWh of battery capacity. This leads to a larger size cell. The new design is a 4680 lithium-ion cylindrical cell (46 mm diameter and 80 mm height) as shown above. This larger form factor also helps the battery serve another role that will be covered in section 5 around cell vehicle integration.

To summarize, the 4680 cell design adds 5x the energy, adds 16% to the EV range and 6x the power compared to the 2170 cell design. The 4680 cell design also allows for faster Supercharger times without over heating. These benefits plus lower costs are critical for the mass adoption of EVs.

2. Cell Factory

Tesla first reviewed mature, high throughput manufacturing processes like printing newspapers and bottle manufacturing to identify key principles with an objective to radically change volume production for cylindrical lithium ion battery cells. The benefits could be to 10x output while also dramatically reducing cost per GWh of cell production. Tesla has stated the 4680 Cell Factory will be 7x more productive and cost 75% less per GWh of cell production.

We will cover Tesla Advanced Manufacturing in a separate update, but the manufacturing of 4680 cell design is tightly linked to the design itself. And Tesla has built a pilot 4680 production facility in Fremont, CA to advance the manufacturing technology for use in the Giga factories later. At Battery Day, Tesla said it was on the 4th generation production line and estimated the 6th generation at the pilot production facility would be ready to scale with 10 GWh annual run rate at that time. Tesla plans to have a 100 GWh annual run rate for production capacity in 2022 and 3 TWh (3,000 GWh) annual run rate in 2030. That is Tesla’s own battery cell production.

Giga Berlin and Giga Austin will likely be the initial Tesla facilities to scale production of the 4680 cells onsite. Giga Nevada will continue to manufacture 2170 cells for use in vehicles until everything is converted to 4680 cells in the future for more scalability, lower cost and better EV performance. Tesla will also be working with 3rd parties to transfer specific battery technologies to further increase 4680 lithium-ion battery cell manufacturing capacity. However, Tesla will likely retain the highest energy density cell chemistries for its own production for use in the higher gross margin Tesla Semi, Cybertruck and Roadster.

3. Anode Materials

The anode requires a material to store lithium ions while charging the battery. Graphite is a common anode material. Graphite powder can either be mined in a natural form or manufactured as synthetic graphite. The graphite is usually coated onto a copper foil using heat. Graphite has proven to be reliable for an extended cycle life.

Silicon has always been of great interest due to its ability to store about 20% more lithium ions by mass than graphite and comparable anode materials with volume expansion. This leads to greater efficiency and energy storage capacity. But silicon anode materials have also historically had a drawback associated with surface oxide passivation that limits it durability with repeated discharge-charging cycles.

Tesla will introduce Tesla silicon with a polymer coating into the 4680 cell anode to reduce the charging time by 50%, provide about 20% more range and reduce cost by 5% over the first few years. It also seems this will be a key area of innovation to further improve battery performance characteristics and cost. Graphite and silicon are readily available in the supply chain although China supplies about 60% of the worlds graphite today. Synthetic graphite production should ramp up over the next few years in the US.

4. Cathode Materials

The cathode material stores lithium ions during battery discharge. The material is usually an oxide made up of various combinations of lithium, nickel, cobalt, manganese, magnesium, aluminum and/or iron phosphate. Examples are lithium nickel oxide (LiNiO2), lithium nickel manganese cobalt oxide (LiNiMgCoO or NMC), and lithium iron phosphate (LiFePO4 or LFP). Pure or high nickel oxides are favored to maximize energy density with low or no use of cobalt due to child labor issues mining it in the Democratic Republic of Congo. However, nickel supplies will need to increase to meet the demand growing demand for this metal in batteries.

Tesla envisions a 3-tiered cathode mix for the 4680 cell design to optimize the cathode characteristics across the product portfolio. Where weight is less of an issue and managing cost is a key factor, Tesla will use an iron based cathode in shorter range EV in emerging markets and the Megapack in a value-based tier. For the mid-tier, Tesla will use nickel manganese to conserve nickel with the use of manganese in longer range EVs in developed markets and the Powerwall for residential battery storage. Tesla will use a high nickel chemistry where energy density is critical. That includes the Tesla Semi, Cybertruck and Roadster.

To summarize, Tesla will provide 3 distinct cathode chemistry configurations for different use cases:

Long Cycle Life: Iron based (emerging market EVs, Megapacks for grid storage)

Long Range: Nickel Manganese (developed market EVs, Powerwalls for homes)

Mass Sensitive: High Nickel (Tesla Semi, Cybertruck)

A key breakthrough announced at Tesla Battery Day was its single cathode crystal patent and process. The primary benefit of this process is the extended cycle life to achieve a 1 million mile battery. Tesla is expected to announce plans for a cathode plant that will source raw materials and utilize this proprietary process to manufacture at least the high nickel cathodes. Tesla has also indicated it will likely vertically integrate into some mining of raw materials.

The largest nickel reserves are located in Indonesia, Australia, Brazil and Russia so Tesla may partner with one or more of those countries and miners like Vale or BHP Billiton to form joint ventures that mine the nickel and process the required inputs to manufacture nickel-based cathodes. To realize the vehicle production projected beyond 2025, Tesla will have to at least commit soon to long term nickel contracts so miners can build out mining capacity to meet the projected demand. These mines takes years to develop and scale. That is why it is likely that Tesla will partner and vertically integrate into mining to finance and source the raw material from this scaled production.

Lithium is another required raw material input and Tesla announced at Battery Day that it has acquired the mineral rights in Nevada to a lithium clay reserve and has created a process using sodium chloride to remove lithium from this clay after mining. The clay can then be returned after the lithium is extracted for a sustainable mining process. Tesla indicated this lithium reserve and process could supply all the lithium needed in North America for EVs. Sourcing raw materials and locating cathode production closer to the country where the final battery cell will be produced and used would streamline the supply chain much more than today where raw materials, batteries and finished goods are transported across the world many times for the final product delivery. This is a component of accelerating the transition to sustainable energy by tightening supply chains.

5. Cell-Vehicle Integration

One of the biggest battery innovations announced at the Tesla Battery Day was the concept of a structural battery cell integrated into the vehicle chassis. This structural integration concept was adopted from the aerospace industry. Many airplane wings integrate jet fuel storage directly into the wing rather than adding tanks inside the wing. This saves cost, weight and streamlines manufacturing as well.

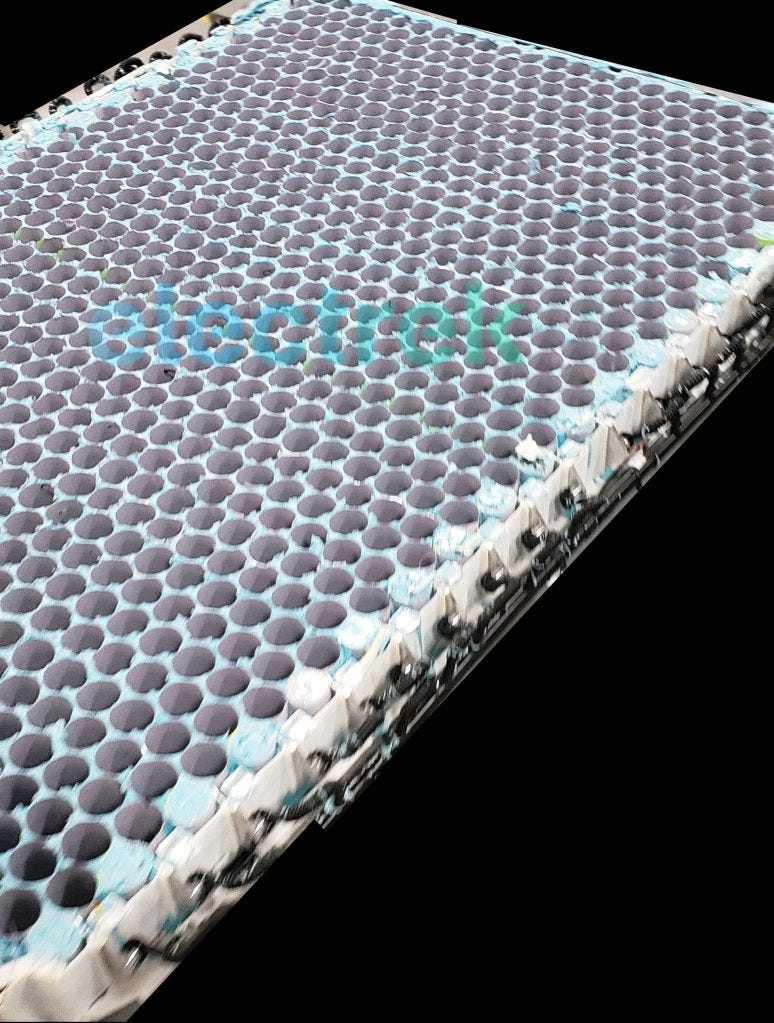

Early prototypes of a Model Y structural battery pack show a honeycomb design as shown above without the 4680 cells. Because of the larger battery size, only an estimated 960 batteries with the 4680 cell design are required vs. 4,416 batteries with the 2170 cell design. The reduced number of cells dramatically decreases the number of connections by about 4x and cooling is simplified with a cooling plate underneath the batteries.

Another critical advantage with this structural battery design for a central chassis component is the integration with single piece castings for the front and rear underbody segments. These components combine as 3 large units to form the entire underbody. This saves assembling many parts to create the underbody with at least over 600 robots eliminated for the front and rear component manufacturing. This boosts efficiency, reduces time and complexity and ultimately reduces the unit production cost in line with Wright’s Law [E3.1]. These improvements are being realized as Tesla approaches an annual production run rate of 1 million vehicles per year.

Conclusion

Ongoing advancements in battery technology are critical for Tesla to enhance vehicle performance, reduce cost and scale production to meet demand for lithium ion batteries for mass market electric vehicle adoption. Battery technology could also be where Tesla fails. Once Tesla is producing millions of units and has invested heavily into its own scaled battery production, a new battery technology breakthrough could provide the disruptive threat to Tesla just as Tesla is currently disrupting incumbent vehicle manufacturers who previously committed to internal combustion engines. But technology alone is not the threat. Disruption requires faster adoption by a competitor who can commercialize and scale the new technology faster than Tesla could convert over if the new technology is truly superior across many dimensions including scaled production.

But the challenge for such a disruption to Tesla will be Tesla’s own ability to innovate and incorporate breakthroughs for a mission that does not prioritize profit or return of capital to shareholders. For shareholders that seems to be a conflict, but in the long run prioritizes a true north star towards a more sustainable energy future. For that reason, Tesla would likely be the early adopter of any new battery breakthrough regardless of the impact on its invested capital in prior technology.

Is there an emerging threat to lithium ion battery technology? A number of new ventures are focused on advancing solid state battery designs and chemistry. One emerged just this week in the Boston area out of stealth mode with $40 million in committed capital to date and ties to many leaders in both the battery and automotive industries. The company is Factorial Energy and they claim to have a groundbreaking 40 amp-hour solid-state battery cell for EVs and other applications like grid storage. QuantumScape is another solid state battery venture that is now a publicly-traded company.

Solid state batteries are lighter, with greater energy density, more range, lower cost and faster recharge times. But creating cell prototypes does not guarantee a new commercial platform that requires many cells to power a vehicle and lasts for 100s of thousands of miles. It seems commercial viability is years away and lithium ion technology with scaled production will continue to advance as well. Tesla’s dry cell design also takes away one advantage of solid state technology against the liquids and gels used in more conventional lithium ion designs.

At the recent Battery Day in September 2020, Tesla announced the commercial scaled production roadmap for its new 4680 lithium ion battery cell design.

10 GWh - NOW - annual run rate realized in a Tesla pilot 4680 cell factory

100 GWh - 2022 - annual run rate realized at Tesla Giga factories

3000 GWh (3 TWh) - 2030 - annual run rate realized at Tesla Giga/Tera factories

The Megapack is another critical addition to utility grid energy storage and large commercial energy storage installations. Weight and and energy density are less critical for these applications versus cost, reliability and long cycle life. Tesla’s battery technology advancements with third parties licensing and adopting 4680 cell manufacturing for iron based cathode chemistries would enable Tesla to scale production in this area while Tesla itself focuses on scaled production for high nickel chemistries. Tesla may also partner with third parties to manufacture 4680 cells for long range nickel manganese chemistries.

The lithium ion battery supply chain could be primary constraint to scaled EV production in the future for Tesla and any other manufacturer. And not just the finished good, but the raw input materials as well. Nickel is likely the most critical raw material that needs to ramp up additional supplies. The critical stage is probably looking out about 3-5 years with larger EV unit volume production. Capital outside the mining industry is needed now to accelerate a scaled build out ahead of revenue to meet the future demand. That invested capital could come from vehicle manufacturers who can sell more vehicles to recover the investment or petrochemical companies threatened by the conversion to EV or of course private equity.

Beyond 2025 the growing end of life supply of lithium ion batteries provides a less conventional means of mining through recycling key materials from disposed batteries. Many cathode materials like nickel can be recovered with excellent yields to put back into battery production for EV and other applications. Redwood Materials near Tesla Giga Nevada is pioneering scaled recovery of raw materials for end of life batteries. The company was founded by Tesla co-founder and past CTO JB Straubel. I expect a strong partnership between Redwood Materials and Tesla once the feedstock for Redwood Materials can provide enough raw material to have a commercial impact on Tesla.

Best,

Stephen

Nothing in this post is intended to serve as financial advice. Do your own research. I’m long TSLA and VALE.